🐐 Explore All Things Wicked | 🔔 Subscribe | 📢 Be a Sponsor

📌AUTHOR’S NOTE: Let’s try this again. Sorry everyone, this article was supposed to be free to access and I messed that up. You should all be able to read and list to this one.

📌 EPISODE SUMMARY:

(Scroll down for the full story)

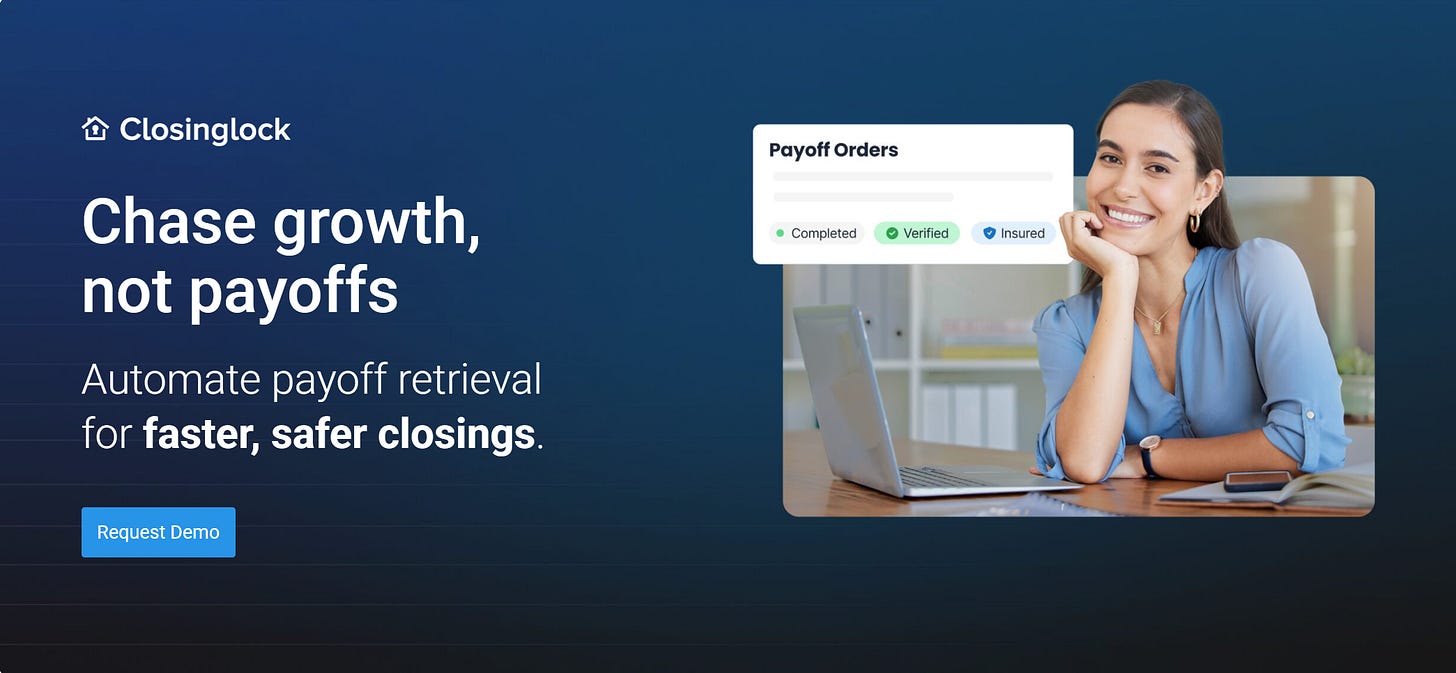

Payoffs suck. They’re tedious, risky, and mostly thankless. But they don’t have to be.

If you’re serious about tightening your process, protecting your clients, and not spending another Friday night elbow-deep in outdated lender portals, it might be time to stop chasing and start automating.

Closinglock’s new tool isn’t a silver bullet. But it’s a damn good wrench for one of the most broken parts of the title process. I grabbed a few minutes of Erin Koops time before she boarded a plan for a much needed vacation, so you’re going to want to keep reading and listen to the podcast for all the juicy details and behind the scenes answers to the questions you’ll want answered about how to automate your mortgage payoff process.

📚 Want to Dig Deeper?

Here’s where you can read more:

🐐 Explore All Things Wicked | 🔔 Subscribe | 📢 Be a Sponsor

🐐 Explore All Things Wicked | 🔔 Subscribe | 📢 Be a Sponsor

Stop Chasing Payoffs

Let’s be honest: if you wanted to spend your days chasing down lender payoff statements, deciphering fee codes, and re-verifying routing numbers last-minute, you probably would’ve just gone into banking.

But here you are—an elite closing command unit, drowning in copy-paste, squinting at scanned PDFs, and calling automated phone trees that seem designed by someone who hates humanity.

This isn’t just annoying. It’s risky. It’s inefficient. And it’s slowly shaving hours (and years) off your life.

But here’s the good news: this isn’t just another article telling you to “work smarter.” We’ve got practical tips, battle-tested fixes, and even a promising new tool from Closinglock that might be a game changer (if you let it).

🚩 The Ugly Truth About Payoffs (That Everyone Pretends Isn’t That Bad)

If you’re new to the job, here’s what the seasoned pros won’t tell you until it’s too late:

Lenders are chaos goblins

They all want something different: fax forms, phone trees, magic incantations. One industry ops blog even noted that “lenders may require title agents to dial into an automated voice message system and spend 5 to 7 minutes tracking down payoff information.” That’s time you’ll never get back. (source)Manual entry is a landmine

Per-diem interest, escrow balances, late fees, fluctuating totals… and you’re expected to rekey all that cleanly? Every slip of the mouse becomes a potential funding delay or six-figure loss. Trust me I know. I still shudder when I think of that time, well over a decade ago, where I accidentally transposed 2 digits when typing and suddenly found myself forking an entire month’s paycheck over to someone else’s lender!Lenders love changing payoffs post-closing

This one’s fun. You wire the payoff based on the letter. A week later? Surprise! Fees changed, they applied a payment, and now the balance is off. Hope you enjoy reconciling that underwriter claim. Hear more about that fiasco in our recent podcast/article episode: 🐐🎙️Closing Isn’t Closure: When Lenders Rewrite the Rules Post Closing.Payoff fraud is real (and growing)

Wire fraud is bad. Payoff fraud is sneakier. Hackers spoof the lender, send you fake statements or routing numbers, and boom—client funds vanish. Just ask Kevin Tacher, who nearly lost everything to a BEC attack he documents in his must read book Intercepted. This isn’t hypothetical. It’s happening.

🧰 Smart Title Teams Are Already Doing This

You may already know these—but the difference between “we know” and “we do every time” is where the risk lives.

Order Early, or Suffer

Get your payoffs 2–3 weeks out. Waiting until the closing crunch is like playing roulette with someone else’s money.Standardize Your Payoff Playbook

Keep a shared doc: which lenders require what, how long they take, who to call when their portal crashes (again). Update it often. It’ll save your team hours. Or ditch the Payoff Playbook entirely and retrieve your payoffs from Closinglock instead.Verify like your E&O depends on it (because it does)

Never fund off a verbal-only payoff. Never accept a statement unless it’s addressed to your company. And if it comes from someone else’s email or process? Re-verify everything. Hilary Herris Fentress at Chicago Title put it plainly: “A payoff statement can be a binding agreement… if the payoff is not directly to your firm or title company, then claims loses that defense.”Audit trails are your best friend in court

Centralize communication. Retain records. Use tools that log who did what when. As Nancy Gusman at Brickhouse Consulting always reminds us, when something goes sideways, that paper trail can be the difference between denial and defense.Train your people (because tech won’t catch everything)

Even the best tools miss red flags. Staff need to recognize the warning signs: last-minute routing changes, suspicious contacts, outdated documents. If your gut says “something’s off,” don’t hit send.

📢 Be a Sponsor | 🔓Paid Subscribers Get Limited Time Free Downloads Here

🤖 The New Tool from Closinglock: Worth a Look?

Now, about that new tool we mentioned.

Closinglock just acquired a payoff retrieval system from Viking Sasquatch. (Yes, that’s a real name. No, we don’t have time to unpack it. Yes, they have the coolest website on the internet!)

Here’s what matters: this system now powers automated, insured payoff retrieval and verification—the kind of thing title agents would’ve sold a kidney for five years ago.

According to Closinglock:

“Once payoff statements are retrieved, they are automatically routed through Closinglock’s verification tool, and every verified payoff is insured for up to $2.5 million.”

So, that risk you were carrying? That time you were burning? Gone.

Andy White, Closinglock’s CEO, put it like this:

“We’re removing one of the most frustrating parts of the job and turning it into a fast, accurate, and secure process.”

Yes, please and thank you!

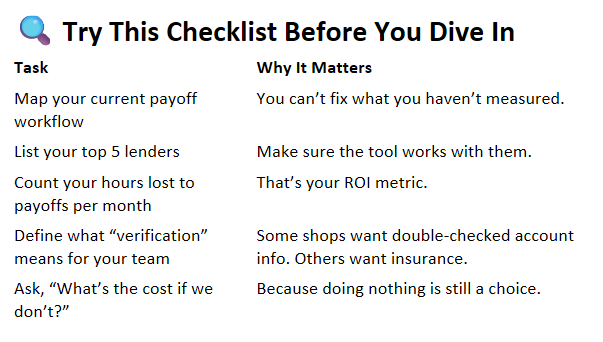

🧠 But Before You Jump In—We Asked Closinglock the Questions We Knew You’d Be Asking Yourself

Because no matter how shiny a tool is, you still need to do your due diligence.

Tori and Erin over at Closinglock were total pros—answering rapid-fire questions, sharing what’s live vs. what’s coming, and even jumping on a Zoom while Erin was literally packing for vacation. Dedication or madness? Either way, I respect it.

Here’s what I learned that you probably really wanted to know—but didn’t want to spend an hour digging around to find out:

❓Is This Fully Automated?

Let’s cut through the fantasy: getting lenders to play nicely with anyone is harder than getting a 2 year old to share their favorite doll.

These historically stubborn lenders still require a disparate minefield of hoops to jump through for submission of third-party payoff requests. That includes many of the big ones. So no, this isn’t a magical integration with all mortgage servicers that instantly delivers your payoff with a bow on top. Trust me, we all wish it were, but remember Closinglock had the help of Viking Sasquatch not the ghost of Robin William’s Genie, that said, I think they did a great job saying, “Poof! What do you need?”

That means Closinglock isn’t plugging into some magic lender API that replaces the whole process. But Closinglock doesn’t pretend it is. What they’ve built is something smarter. As Erin Koops put so well…

🗣️ “The automation isn’t about skipping steps—it’s about handling every one of those annoying manual steps for you so your team doesn’t have to.”

Centralized Tool

Their system starts with a centralized tool that guides you through 3 simple steps to ensure you fulfill all the lender-specific requirements (even when they require fax, email, or call center submissions) and preps the correct documents, in the correct format, with the necessary bits of data.

This alone is huge! Erin’s seen firsthand the Rolodex’s and Excel spreadsheets that title teams keep when trying to keep track of dozens of lenders, how to get in touch with them, the hoops you need to jump through, and how long they take.

Data Collection

Next, Closinglock helps you with the Data Collection to obtain all the key information from borrowers in a secure, private environment, so that none of that data is flowing unencrypted. Closinglock even offers a Borrower-friendly eSign tools to collect required authorizations.

Bonus: If the borrower already completed IDV (ID verification) via Closinglock, the system can pre-fill their details for you. Less typing. Less room for error. Less wasted time for everyone.

🗣️ “We’re hearing a lot of excitement about having everything in the same place.” – Tori, Closinglock

Built-in Tracking, Notifications and Audit Trails

Their Built-in tracking allows you can see what’s been sent, what’s still pending, and receive proactive notifications when it’s time to follow-up, so you have less friction and less last minute ‘oh-crap’ moments. As Erin pointed out, usually agents “need to take notes somewhere outside the Rolodex of when I sent the payoff request. And if you’re really organized, you’re adding a note to a calendar of when you should expect it back, but let’s be honest, they’re juggling all of these files, so, even if I realize it’s been too long, it’s probably because I’m looking for the final payoff to do the closing, and then I have to kind of go into overdrive trying to tack it down.”

Been there. Done that.

What Erin said really stuck with me, “This is the first time that the title agent doesn’t have to be the one that’s tracking all of it. They don’t have to think about whether they got the Authorization to Release, whether it’s been submitted, whether they got the payoff. That part’s all tracked. You don’t have to write on a piece of paper. ‘I sent this request on, Tuesday, I expect it in two weeks.’ We’re keeping all of that front and center for you within your closing lock file.”

Notifications

Now, did Closinglock sit back on their laurels after all that? Nope.

Erin continued, explaining that after the payoff request has been sent, “We are, in real time, alerting a customer that something is off, maybe a payoff hasn’t arrived in a timely manner, or a piece of data is incorrect or missing,” shared Erin. “Sometime an agent might need to step in sooner, and our notification system ensures that they’re not just figuring it out, you know, the day of closing.”

“There are occasions,” Erin continued, “my understanding from our customers, where they will incorrectly submit information, like, wrong borrower name. I picked husband’s name and wife’s name is actually the borrower on the loan by itself. Closinglock is able to immediately surface that back from the lender to the agent so that they can quickly change it and resubmit rather than losing a week or more waiting for a payoff that never arrives.”

Audit Trails and File Storage

Everything—request, payoff, verification, borrower authorization—is in one place.

In short: Closinglock is not eliminating the lender idiosyncrasies; they’re absorbing them—so your team doesn’t have to. Closinglock bundles all the moving parts into one interface. You stay in one place. No fax machines. No hunting down forms from three closings ago.

✍️ Borrower Authorization: How’s That Handled?

Most lenders still require it. That’s not Closinglock’s rule—it’s the industry’s. But they’ve made it frictionless:

Use their built-in eSign request tools

Upload your own if you prefer your internal process

Let the system pre-fill borrower details if they’ve completed IDV in Closinglock (which Erin said has a 98% success rate)

“That’s one of the benefits of our platform,” Erin noted. “We already have their information. So we can pre-fill the Authorization to Release and send it out in seconds.”

That might not sound flashy—but if you’ve ever had to explain to a seller what a payoff authorization is for the third time, you know how much time and patience this saves.

Wicked Title Forum is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

🐐 Explore All Things Wicked | 🔔 Subscribe | 📢 Be a Sponsor

❓Lender Coverage: Who’s on the list?

Ok, I’m sure you’re dying to know who’s on the list of lenders, so was I, but this one is proprietary information. Erin did share however, that “We’re excited because it represent the majority of coverage of U.S. loans across lenders and MSPs.”

Nice! But I didn’t let them off that easy, and followed-up asking, “So, if somebody needs a payoff from a lender and they’re not currently in your list, are they able to still use your system to submit, or are they doing that entirely outside of your system?”

Erin confirmed that at this time you would need to do that using your current workflow outside the Closinglock system, but she assured me that on the rare occasion you need a lender they don’t have, Closinglock has built in a feedback form so you can alert them when they are missing a lender and they will be actively adding to that list over time.

She also assured me that selecting the lender is the very first step, so you won’t waste a second of your time filling in fields in the event the lender isn’t yet available.

Can we really ask for anything more from a brand new feature?

🧾 What’s On the Payoff Statement? (And Can I Trust It?)

Yes, the statements are detailed—down to the good-through date, accrued interest, principal balance, late fees, and even lender instructions. You’ll also see the verification status and insurance details front and center.

If your audit trail needs to show that you did your due diligence? You’ll have receipts.

🕵️♀️ Audit Trails: Can I Prove What Was Ordered, When, and by Whom?

Yep. The Closinglock file shows:

Who requested the payoff

What data was used

When it was ordered

When it was fulfilled

Status of verification

Seller auth file

Downloadable PDF copy of everything

Translation: If something goes sideways, you’re not guessing what happened—you’ve got the paper trail.

🔁 What About Updates? Payoff Changed? Closing Pushed?

Here’s the scoop:

No, the system doesn’t automatically detect if the lender suddenly changes the payoff after it was retrieved (e.g., added fees, seller made a payment, etc.)

Yes, you can re-request a new payoff easily if something changes. That re-order would incur an additional charge, unless you’re on a subscription plan which includes unlimited payoff requests.

🗣️ “We don’t capture dynamic updates—yet. But reordering is simple, and fixed-cost subscriptions are available for teams who want price predictability.” – Erin, Closinglock

For now, if your seller pays another mortgage payment or you’re staring down a foreclosure payoff that likes to mutate overnight, you’ll still want to use your smarts and request a new payoff accordingly.

📄 Can I Print It? Download It? Save It to the File?

Yes. Yes. And yes.

Every payoff statement and verification receipt is stored in the file, downloadable as a PDF. You can send it, save it, print it, and if you still need to overnight a check with documentation or email a package to an old-school lender who only accepts PDFs by carrier pigeon, you’re good.

🧠 Want More Conversations Like This One?

Join us at WTF LIVE: The Title Think Tank—a monthly mastermind group where title pros like you come together to swap war stories, compare notes, and crowdsource real-world solutions to the industry’s most frustrating problems.

💬 Got payoff pain? Compliance chaos? Questions no one else is answering?

🔍 We’ll dig into it all—live, unscripted, and unfiltered.

➡️ Click here to reserve your seat for the next WTF LIVE

Seats are limited. Whiners stay home. Thinkers welcome.

🎥Meeting Links | ▶️ Replay Links | 💬 Community | 📜Articles | 🦊 Join

🔮 What This Could Mean for Your Workflow

If you take advantage of Closinglock’s new service, here’s what changes:

You get your nights back. No more tossing and turning with nightmares about chasing down lenders while a giant clock ticks with a deafening roar. Oh, that’s just me? I don’t believe you.

You look smarter to clients. Clear timelines, fewer surprises, smoother closings.

You carry less liability. Verified, insured, auditable. That’s a lot safer than “Susan said it looked fine.”

You stand out from the title crowd. Faster, safer, smoother = more referrals.

Even better? For some states, the cost of this service may qualify as a pass-through. That means you’re not paying it—the file is.

This isn’t some miracle fix where AI takes over every lender relationship. Lender-side fragmentation is still a beast—and Closinglock isn’t pretending otherwise. But they’re doing what most tools haven’t: building automation and structure around the chaos so your team doesn’t have to absorb the full impact.

The value isn’t just in speed. It’s in structure:

Title teams don’t have to hunt, follow up, or guess

Authorizations are collected, tracked, and stored

Everything’s insured and auditable

And the platform doesn’t get in your way when you need to go old-school

It’s still your process. You’re still the one accountable for ensuring your deal closes cleanly. But now, you’re not doing it alone with duct tape and spreadsheets.

And if something does go sideways, you’ve got the receipts.

And let’s be real—your processors weren’t hired for their love of fax machines or automated phone systems. It pays to keep them happy and stress free.

Let’s call Closinglocks new payoff automation what it is: a massive reduction in the time, effort, and risk it takes to chase down payoffs and double-check what you’re wiring.

🧠 Payoffs suck. They’re tedious, risky, and mostly thankless. But they don’t have to be.

If you’re serious about tightening your process, protecting your clients, and not spending another Friday night elbow-deep in outdated lender portals, it might be time to stop chasing and start automating.

Closinglock’s new tool isn’t a silver bullet. But it’s a damn good wrench for one of the most broken parts of the title process.

📚 Want to Dig Deeper?

Here’s where you can read more:

Closinglock’s New Feature Details

Streamline Your Process: How to Order a Mortgage Payoff Efficiently

Closinglock Discusses The Reality of Real Estate Fraud in 2025 that the FBI’s IC3 isn’t Reporting

Click More articles from Wicked Title Forum about Mortgage Payoffs…

P.S. Can you find and decipher the hidden message on the Viking Sasquatch website? Hit reply, reveal your nerdy hidden self, and tell me what it is to win a free 3 month subscription to the Wicked Title Forum!

Stay Wicked,

Cheryl

If you enjoy my writing, please support me with a clap, comment, follow, or subscribe.

🐐 Explore All Things Wicked | 🔔 Subscribe | 📢 Be a Sponsor

**DISCLAIMER**

The Wicked Title Forum is a collaborative resource. If you spot something outdated or inaccurate, leave a comment—we’ll get it fixed.

All sample forms, procedures, and instructional content are for general educational purposes only. They are not legal, financial, or underwriting advice, and should not be relied upon without first consulting with your attorney, underwriter, or compliance officer. Use of this material is at your own risk.

Some links may be affiliate or sponsor links. That means I might earn a commission—at no extra cost to you—if you click. I only recommend things I use, trust, or have personally reviewed.